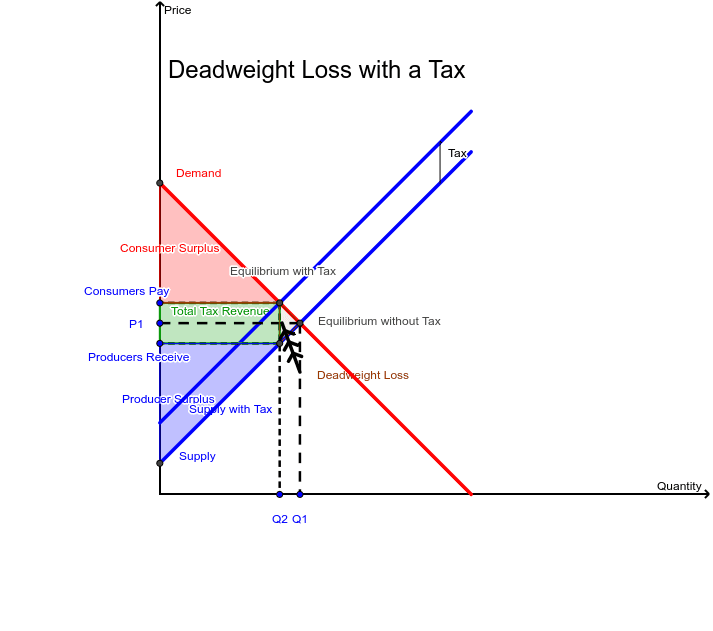

Producer Surplus With Tax . producer surplus is the total amount that a producer benefits from producing and selling a quantity of a good at the market price. Consumers pay a higher price, p 1, and buy less salt. consider a tax imposed on producers by the government. the amount that a seller is paid for a good minus the seller’s actual cost is called producer surplus. In figure 1, producer surplus is the area labeled g—that is, the. A consumer tax eventually brings down the quantity demanded. producer surplus is the difference between the price that producers are willing and able to supply a product for and the price they receive. In the diagram, we see the impact of a tax when demand is price sensitive (i.e. Suppose you are a politician that wants to tax a product. what is the change in producer surplus, change in consumer surplus, and deadweight loss? What is producer surplus after tax?

from www.geogebra.org

what is the change in producer surplus, change in consumer surplus, and deadweight loss? A consumer tax eventually brings down the quantity demanded. producer surplus is the total amount that a producer benefits from producing and selling a quantity of a good at the market price. consider a tax imposed on producers by the government. In the diagram, we see the impact of a tax when demand is price sensitive (i.e. Consumers pay a higher price, p 1, and buy less salt. producer surplus is the difference between the price that producers are willing and able to supply a product for and the price they receive. Suppose you are a politician that wants to tax a product. In figure 1, producer surplus is the area labeled g—that is, the. the amount that a seller is paid for a good minus the seller’s actual cost is called producer surplus.

Deadweight Loss with a Tax GeoGebra

Producer Surplus With Tax consider a tax imposed on producers by the government. what is the change in producer surplus, change in consumer surplus, and deadweight loss? Consumers pay a higher price, p 1, and buy less salt. consider a tax imposed on producers by the government. producer surplus is the total amount that a producer benefits from producing and selling a quantity of a good at the market price. producer surplus is the difference between the price that producers are willing and able to supply a product for and the price they receive. In the diagram, we see the impact of a tax when demand is price sensitive (i.e. A consumer tax eventually brings down the quantity demanded. the amount that a seller is paid for a good minus the seller’s actual cost is called producer surplus. Suppose you are a politician that wants to tax a product. In figure 1, producer surplus is the area labeled g—that is, the. What is producer surplus after tax?

From www.chegg.com

Solved 2. Taxes and welfare Consider the market for Producer Surplus With Tax Suppose you are a politician that wants to tax a product. What is producer surplus after tax? producer surplus is the difference between the price that producers are willing and able to supply a product for and the price they receive. A consumer tax eventually brings down the quantity demanded. consider a tax imposed on producers by the. Producer Surplus With Tax.

From www.mrbanks.co.uk

CONSUMER AND PRODUCER SURPLUS AQA Economics Specification Topic 4.1 Producer Surplus With Tax Suppose you are a politician that wants to tax a product. Consumers pay a higher price, p 1, and buy less salt. producer surplus is the difference between the price that producers are willing and able to supply a product for and the price they receive. In figure 1, producer surplus is the area labeled g—that is, the. . Producer Surplus With Tax.

From dxosohtyj.blob.core.windows.net

Producer Surplus Formula With Price Floor at Richard Thomas blog Producer Surplus With Tax the amount that a seller is paid for a good minus the seller’s actual cost is called producer surplus. In figure 1, producer surplus is the area labeled g—that is, the. What is producer surplus after tax? what is the change in producer surplus, change in consumer surplus, and deadweight loss? In the diagram, we see the impact. Producer Surplus With Tax.

From www.slideserve.com

PPT Lecture 6 Consumer’s and Producer’s Surplus PowerPoint Producer Surplus With Tax producer surplus is the difference between the price that producers are willing and able to supply a product for and the price they receive. producer surplus is the total amount that a producer benefits from producing and selling a quantity of a good at the market price. Consumers pay a higher price, p 1, and buy less salt.. Producer Surplus With Tax.

From www.slideserve.com

PPT Lecture 6 Consumer’s and Producer’s Surplus PowerPoint Producer Surplus With Tax producer surplus is the difference between the price that producers are willing and able to supply a product for and the price they receive. consider a tax imposed on producers by the government. Consumers pay a higher price, p 1, and buy less salt. producer surplus is the total amount that a producer benefits from producing and. Producer Surplus With Tax.

From www.chegg.com

Solved Complete the following table by using the previous Producer Surplus With Tax consider a tax imposed on producers by the government. what is the change in producer surplus, change in consumer surplus, and deadweight loss? In the diagram, we see the impact of a tax when demand is price sensitive (i.e. A consumer tax eventually brings down the quantity demanded. producer surplus is the total amount that a producer. Producer Surplus With Tax.

From www.youtube.com

How to Calculate the Impact of Export Tax Consumer and Producer Surplus Producer Surplus With Tax What is producer surplus after tax? Consumers pay a higher price, p 1, and buy less salt. producer surplus is the difference between the price that producers are willing and able to supply a product for and the price they receive. what is the change in producer surplus, change in consumer surplus, and deadweight loss? consider a. Producer Surplus With Tax.

From www.bartleby.com

Answered Complete the following table by using… bartleby Producer Surplus With Tax consider a tax imposed on producers by the government. what is the change in producer surplus, change in consumer surplus, and deadweight loss? producer surplus is the total amount that a producer benefits from producing and selling a quantity of a good at the market price. In figure 1, producer surplus is the area labeled g—that is,. Producer Surplus With Tax.

From www.slideserve.com

PPT Tax Incidence and Deadweight Loss PowerPoint Presentation, free Producer Surplus With Tax producer surplus is the difference between the price that producers are willing and able to supply a product for and the price they receive. Suppose you are a politician that wants to tax a product. What is producer surplus after tax? A consumer tax eventually brings down the quantity demanded. In the diagram, we see the impact of a. Producer Surplus With Tax.

From inescm-images.blogspot.com

At The Equilibrium Price Producer Surplus Is What is consumer surplus Producer Surplus With Tax Suppose you are a politician that wants to tax a product. producer surplus is the total amount that a producer benefits from producing and selling a quantity of a good at the market price. A consumer tax eventually brings down the quantity demanded. Consumers pay a higher price, p 1, and buy less salt. In the diagram, we see. Producer Surplus With Tax.

From www.slideserve.com

PPT Consumer and Producer Surplus PowerPoint Presentation, free Producer Surplus With Tax producer surplus is the total amount that a producer benefits from producing and selling a quantity of a good at the market price. producer surplus is the difference between the price that producers are willing and able to supply a product for and the price they receive. In figure 1, producer surplus is the area labeled g—that is,. Producer Surplus With Tax.

From piigsty.com

Economics 101 (9) Consumer and Producer Surplus piigsty Producer Surplus With Tax In figure 1, producer surplus is the area labeled g—that is, the. the amount that a seller is paid for a good minus the seller’s actual cost is called producer surplus. consider a tax imposed on producers by the government. A consumer tax eventually brings down the quantity demanded. Consumers pay a higher price, p 1, and buy. Producer Surplus With Tax.

From www.slideserve.com

PPT Taxes PowerPoint Presentation, free download ID3770416 Producer Surplus With Tax In figure 1, producer surplus is the area labeled g—that is, the. Suppose you are a politician that wants to tax a product. producer surplus is the total amount that a producer benefits from producing and selling a quantity of a good at the market price. Consumers pay a higher price, p 1, and buy less salt. the. Producer Surplus With Tax.

From quizlet.com

Economics consumer and producer surplus Diagram Quizlet Producer Surplus With Tax producer surplus is the difference between the price that producers are willing and able to supply a product for and the price they receive. producer surplus is the total amount that a producer benefits from producing and selling a quantity of a good at the market price. consider a tax imposed on producers by the government. Suppose. Producer Surplus With Tax.

From www.educba.com

Producer Surplus Formula Calculator (Examples with Excel Template) Producer Surplus With Tax Suppose you are a politician that wants to tax a product. In figure 1, producer surplus is the area labeled g—that is, the. A consumer tax eventually brings down the quantity demanded. the amount that a seller is paid for a good minus the seller’s actual cost is called producer surplus. producer surplus is the total amount that. Producer Surplus With Tax.

From www.youtube.com

Difference Between Consumer surplus and Producer surplus YouTube Producer Surplus With Tax the amount that a seller is paid for a good minus the seller’s actual cost is called producer surplus. Consumers pay a higher price, p 1, and buy less salt. In the diagram, we see the impact of a tax when demand is price sensitive (i.e. Suppose you are a politician that wants to tax a product. producer. Producer Surplus With Tax.

From www.chegg.com

Solved 5. Calculate the before and after consumer surplus Producer Surplus With Tax Suppose you are a politician that wants to tax a product. What is producer surplus after tax? consider a tax imposed on producers by the government. what is the change in producer surplus, change in consumer surplus, and deadweight loss? the amount that a seller is paid for a good minus the seller’s actual cost is called. Producer Surplus With Tax.

From econ101notes.blogspot.com

ECON 101 Notes Consumer Surplus, Producer Surplus and Taxes Producer Surplus With Tax producer surplus is the difference between the price that producers are willing and able to supply a product for and the price they receive. producer surplus is the total amount that a producer benefits from producing and selling a quantity of a good at the market price. Consumers pay a higher price, p 1, and buy less salt.. Producer Surplus With Tax.